As we age, aside from the physical limitations we all fear and experience, there is one fear which is overarching – “What is to become of me?” Unfortunately, aging means our strength wanes as does our ability to care for and provide for ourselves. That is why it is so important to plan ahead while we are young and strong. Luckily, that is exactly when long term care insurance for homecare and senior care in Brooklyn is most reasonably priced.

Why Is Long Term Care Insurance So Important?

There usually comes a time in most people’s lives when they are no longer able to care for themselves. It may start with not being able to shop for food and cook for yourself. That may progress into not being able to perform the basics of personal care such as bathing and grooming. If mental ability wanes or dementia starts to set in, it may be unsafe to be left alone at home. You may forget to turn off a fire in the kitchen or water in the bathtub. You may even wander off and get lost … or worse. The list is endless.

When Should You Start Planning?

Those who are middle aged should make it their business to know their options for home care or residential care while they are fit mentally and physically. They need to make sure physical and financial resources are in place so that they are free to live their twilight years as they wish. Like life insurance, you must also be in good health to qualify for long term insurance. Furthermore, like life insurance, your long-term care insurance premium is based on your age.

What Does A Plan Look Like?

Most people prefer to stay in their homes for as long as they can. For that, you must be able to afford homecare and home health aides. These paraprofessionals are trained and certified to deal with older adults and their needs. While there are programs such as Medicare and Medicaid, these usually allow for very restricted benefits and hours. Medicaid has asset restrictions as well. Having the proper home healthcare provides for the needs of the elderly and relieves the worry and burden for their loved ones. As such, long-term care insurance was created so that you will be able to afford this help.

What is Long Term Care Insurance?

If you require assistance with the activities of daily life (ADLs), long term care insurance will cover a certified home health aide to help you. ADLs include bathing, dressing, eating, toileting, grooming, getting in and out of bed. The doctor will need to sign off on this to trigger your benefits because there must be a medical necessity. Care of this sort can be provided in a home or in a facility such as assisted living or a nursing home. Home health aide care usually starts at home which is where most families prefer to start off. Unfortunately, symptom progression in the elderly may make a move to a facility necessary.

What Are the Questions to Ask?

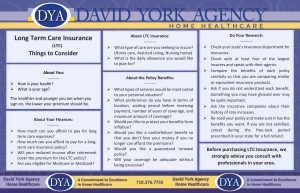

There are so many benefits, features, and plans that it is worthwhile to consult a professional to make sure you are getting appropriate coverage for your specific situation. David York Agency has developed a list of questions that you can use as a springboard as you begin your research. Your age, health, financial situation, and personal preferences are all critical factors to consider in shopping for your policy. We have the whitepaper on our Resources Free Downloads page which you are welcome to print out, Long Term Care Insurance: Things to Consider.

There are so many benefits, features, and plans that it is worthwhile to consult a professional to make sure you are getting appropriate coverage for your specific situation. David York Agency has developed a list of questions that you can use as a springboard as you begin your research. Your age, health, financial situation, and personal preferences are all critical factors to consider in shopping for your policy. We have the whitepaper on our Resources Free Downloads page which you are welcome to print out, Long Term Care Insurance: Things to Consider.

There are a host of other resources to help you navigate this area in the world of senior care. The National Association of Insurance Commissioners and the New York State Department of Financial Services have solid guidance on what to look for when purchasing long term care insurance. NYS even has their own checklist. We suggest you educate yourself before moving onto contacting a financial professional to help you purchase a plan.

How Much Coverage Do I Need?

That is literally the million dollar question. That depends on your state of health, financial resources, and personal preferences. Interestingly, there are some online calculators that could help you get a sense of what you need. We do not suggest that you use these as the final figure, but they do give you an idea of what you will want to discuss with the financial professional that sells these policies. This Long-Term Care Cost Calculator from the AARP was updated in July of 2022. It is a good way to compare costs, types of service in your area.

David York Agency Home Healthcare Can Help Seniors in Brooklyn

At David York Agency, we understand the many challenges and risks faced by the aging and elderly and are dedicated to providing care to support them through all of those ups and down. At David York Home Healthcare Agency, extraordinary service is what sets us apart from other companies in Brooklyn that provide in home healthcare services.

DYA we could provide direction as to how to manage the total care of your senior loved one. Whatever your care needs, we are there for you, always striving to exceed your expectations. For more information about David York Agency’s qualified, compassionate caregivers, contact us at (718) 376-7755. A free phone consultation can help you determine what services would meet your needs. We aim to provide you and your loved one with the assistance they need. If you’d like to hear more from us, please like us on Facebook or follow us on Twitter or LinkedIn.

For more helpful tips and information, check out our blog or contact us today.